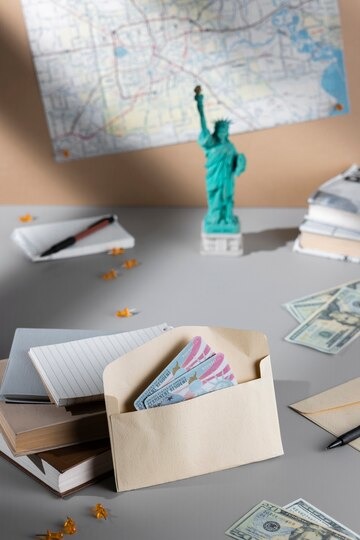

How to Build Wealth and Discover the Best Passive Income Ideas

In today’s world, many people are looking for ways to build wealth and earn money with less effort. This is especially true as living costs rise, jobs become less stable, and traditional retirement plans don’t always work out as expected. If you’re asking yourself how to build wealth and create extra streams of income, you’re not alone.

This article will help you understand some of the best passive income ideas, and explain ways to generate passive income in simple terms. Whether you’re just starting out in your career or you’re looking to earn extra money on the side, there are many options to help you grow your wealth over time.

What Is Passive Income?

Before we dive into the different ideas, let’s first understand what passive income means. Passive income is money you make without putting in a lot of active work every day. It’s not about working hours for wages but instead earning money through investments, businesses, or systems that run mostly on their own once set up.

For example, if you invest in stocks or buy property to rent out, you can earn money without working every day. It might take some effort and time to get started, but once you’ve built up these income sources, they can earn you money even when you’re not actively working on them.

How to Build Wealth: Starting with the Basics

Now that you understand passive income, let’s look at how to start building wealth. It’s important to focus on managing your money well before you start investing or looking for ways to earn passive income. Building wealth takes time, but by following a few simple steps, you can get on the right track.

- Track Your Spending and Save Regularly: The first step in how to build wealth is knowing where your money goes. Make a budget to track your income and expenses. The more you save, the more you can eventually invest to grow your wealth.

- Pay Off Debt: High-interest debt, like credit card debt, can quickly drain your savings. Try to pay off your debt as soon as possible so you can free up money for investing.

- Create an Emergency Fund: Set aside enough money to cover 3 to 6 months of living expenses. This money can help you avoid financial stress in case something unexpected happens, like losing your job or facing an emergency.

- Invest Your Money: Once you have your basics covered, start investing. You can invest in retirement accounts like IRAs or 401(k)s, or put money into stocks, bonds, or real estate. The earlier you start, the more time your investments have to grow.

- Increase Your Income: Look for ways to earn more money, such as taking on a side job or learning new skills that can help you earn a higher salary. More income means more money to save and invest.

Best Passive Income Ideas in the USA

Now that we’ve covered the basics of how to build wealth, let’s look at some of the best passive income ideas you can start today. These ideas are simple to understand and can help you start earning money with less effort over time.

1. Real Estate Investment

One of the most popular ways to earn passive income is by investing in real estate. When you own a property, you can earn money by renting it out. While being a landlord requires some work, you can hire someone to manage the property for you, making it mostly passive.

- Rental Properties: If you buy a house or apartment and rent it out, you’ll get regular payments from your tenants. This can be a steady source of passive income.

- Real Estate Investment Trusts (REITs): If you don’t want to buy physical property, you can invest in REITs. These are companies that own properties and pay you a share of the profits in the form of dividends.

- Vacation Rentals: If you have a property in a popular tourist area, you can rent it out as a short-term vacation rental on websites like Airbnb. This can be a great way to earn extra income.

2. Dividend Stocks and Bonds

Investing in stocks or bonds is another way to create passive income. When you buy stocks from companies that pay dividends, you’ll receive money regularly, without having to sell your shares. Bonds work similarly—they pay interest over time.

- Dividend Stocks: Look for companies that regularly pay dividends to their investors. Some well-known companies, like Coca-Cola and Johnson & Johnson, are popular choices for dividend investors.

- Bonds: Bonds are a safer investment compared to stocks. When you buy a bond, you lend money to a company or government, and in return, they pay you interest.

3. Start a Blog or YouTube Channel

If you enjoy creating content, starting a blog or YouTube channel could be a great way to earn passive income. It takes time to build an audience, but once you have a following, you can earn money through ads, affiliate marketing, or sponsorships.

- Blogging: You can make money through ads or by promoting products and earning a commission (affiliate marketing). Once your blog is set up and popular, it can generate income with very little effort.

- YouTube: You can make money from ads that play on your videos. If you create content that people like and share, your channel can become a source of passive income.

4. Peer-to-Peer Lending

Peer-to-peer (P2P) lending is a way to lend money to others online through platforms like LendingClub or Prosper. In return, you earn interest on the money you lend. While it can be risky, it’s another option for earning passive income.

5. Create and Sell Online Courses or E-books

If you have expertise in a particular area, consider creating an online course or writing an e-book. You can sell these products online and earn money every time someone buys them. Websites like Udemy, Teachable, and Amazon Kindle Direct Publishing make it easy to get started.

6. Affiliate Marketing

Affiliate marketing is when you promote other people’s products and earn a commission when someone buys through your link. You can promote products through a blog, social media, or email newsletters.

- Starting a Niche Website: You can create a website based on a specific topic (like cooking, travel, or technology) and promote products related to that niche. When people buy through your affiliate links, you earn a commission.

- Social Media: If you have a following on platforms like Instagram or Facebook, you can promote products and earn money from affiliate sales.

Ways to Generate Passive Income: Diversify Your Income Streams

While it’s great to explore best passive income ideas, it’s important to not rely on just one source of income. By having multiple ways to earn passive income, you reduce the risk of losing all your income if one source stops working. For example, if your rental property isn’t doing well, your investments in dividend stocks or your blog can still provide money.

Additional Tips for Success

- Be Patient: Building passive income takes time. Don’t expect to make a lot of money overnight. Whether it’s renting a property or building a blog, it might take months or even years before you see significant returns.

- Reinvest Your Earnings: To grow your wealth faster, reinvest the money you earn from passive income. For example, reinvest dividends or rental income into more stocks or properties.

- Keep Learning: Stay educated about personal finance and investing. The more you learn, the better decisions you can make about where to invest your money.

Wrapping Up: Start Your Journey to Passive Income Today

Building wealth and earning passive income is possible for anyone who is willing to put in the effort and time. By understanding how to build wealth and exploring best passive income ideas, you can start creating money-making opportunities that require less active work over time. Whether it’s investing in real estate, stocks, or starting a blog, there are many ways to grow your wealth and create financial freedom. So take the first step today and begin your journey toward building long-term passive income!